Finding the balance between cash and financing

Our customers are usually surprised to learn that solar is not only affordable but frequently generates positive cash flow immediately, which can be used to fuel growth or drop to the bottom line. Solar cash flows have four components:

- Savings on electricity no longer purchased (positive)

- State and Federal subsidies (positive)

- Financing costs (negative)

- Tax effects (positive and negative)

Through financing, the net of these cash flow impacts are an initial cash flow improvement, and frequently a positive cumulative cash flow for the next 20+ years, with no cash outlay.

For example, here are pro forma cash flows from a bank-financed 130 kW project we completed in 2022.

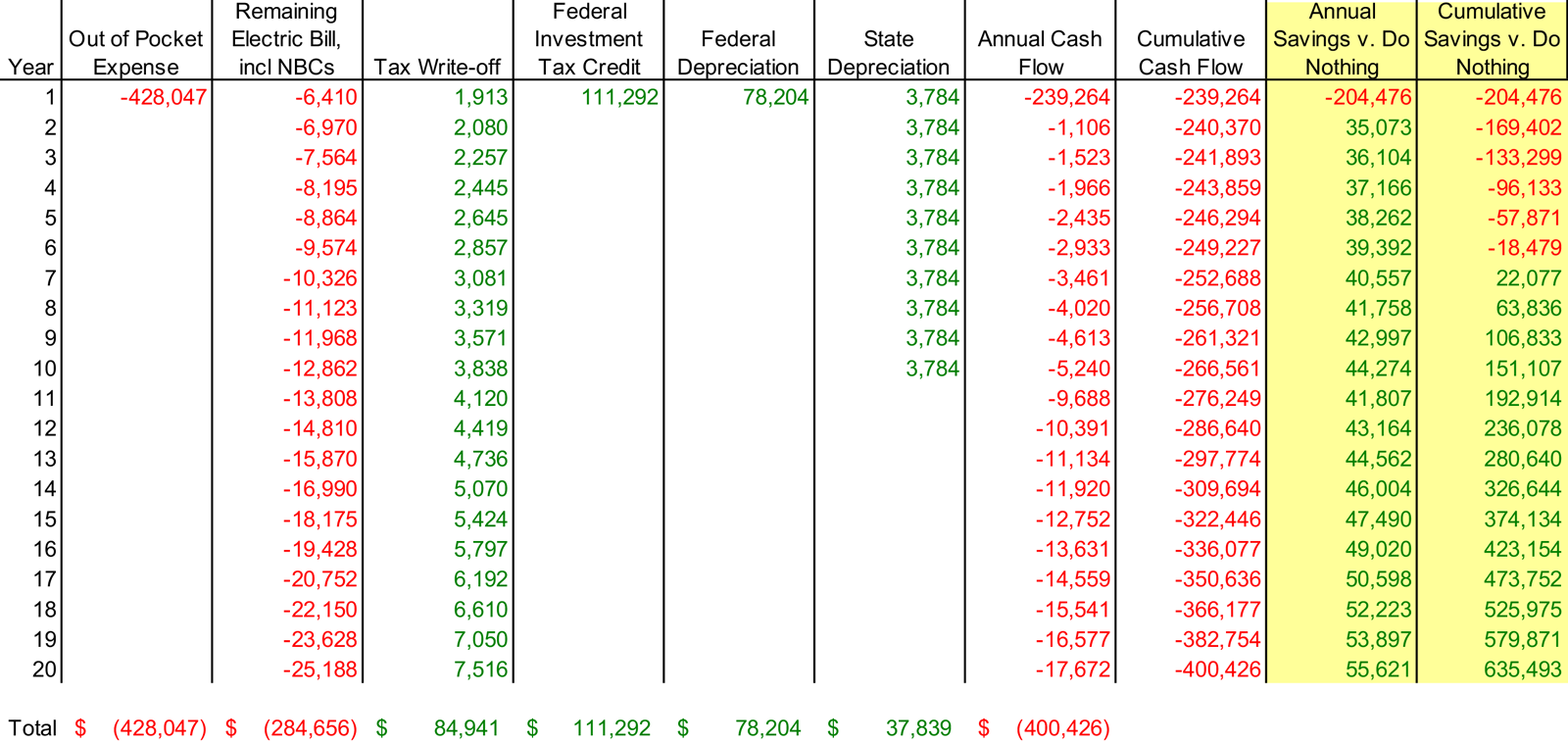

Pro Forma Cash Flow – Cash Purchase

With a cash purchase, there’s an initial outlay ($428,047) and the customer recoups that expense through savings and tax benefits, such that their payback would be ~6.5 years. But “payback” only applies if there was a cash outlay. The overwhelming majority of our projects are debt-financed against the customers’ property.

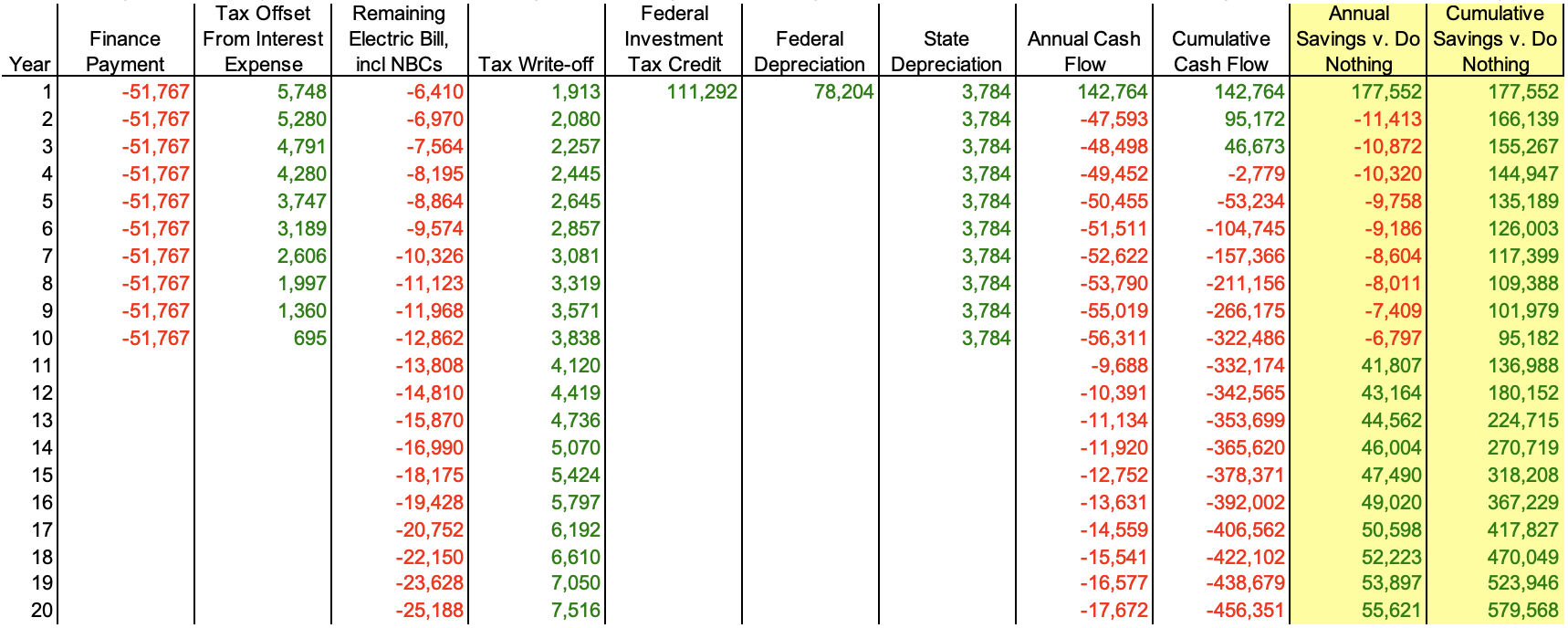

Pro Forma Cash Flow – Loan-financed

A mortgage is often the lowest-cost financing mechanism for solar for business. With no credit evaluation beyond assessing adequate loan-to-value, and a federal mortgage interest deduction, this solar finacing method typicall yields immediate cash flow gain with savings greater than expenses.

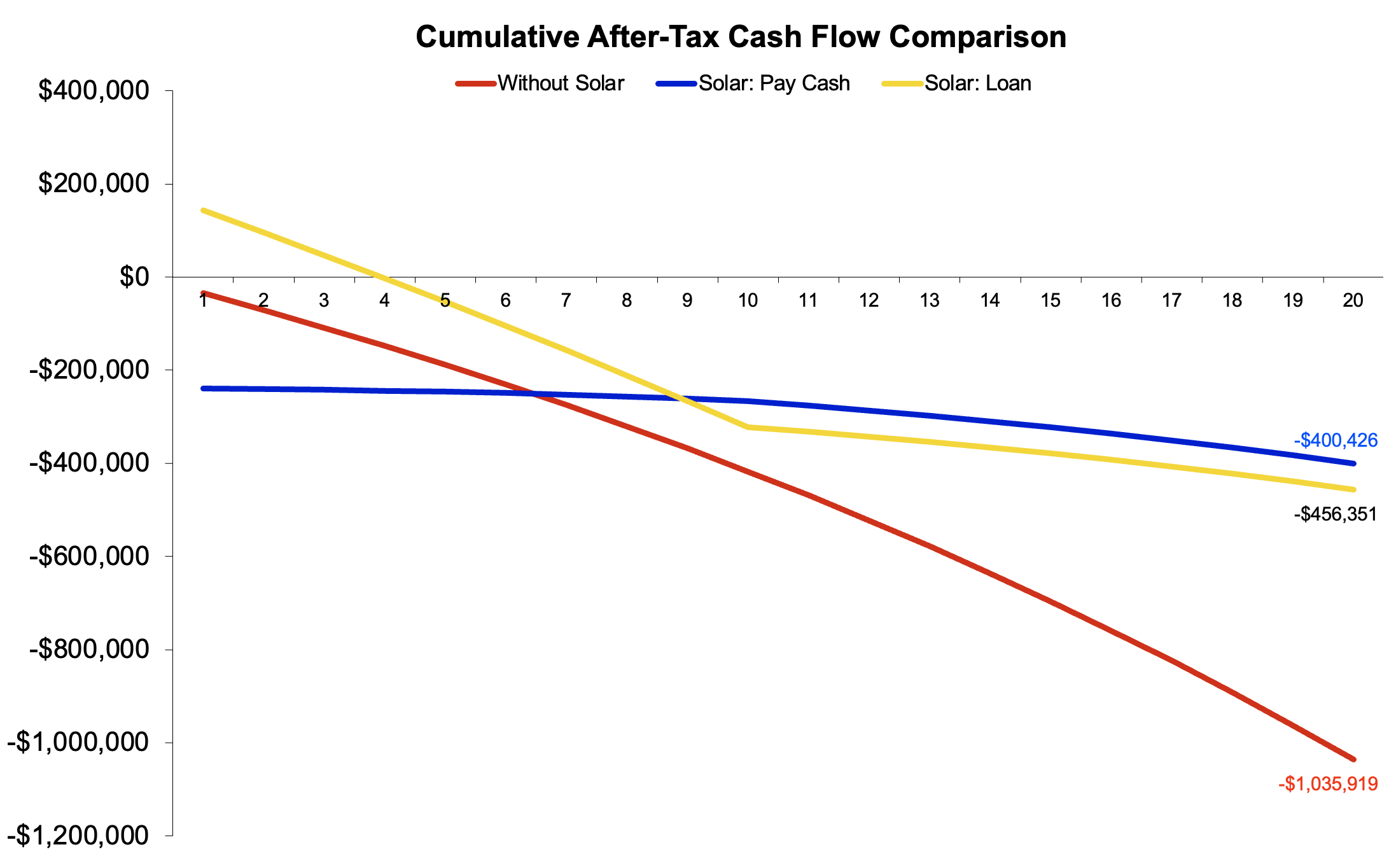

Pro Forma Cash Flow – Comparison

Debt-finacing backed by real estate, leases, PACE financing, Power Purchase Agreements, even pre-paid PPAs funded by leases — there’s a wide range of options to finance commercial solar. Sunlight Electric isn’t tethered to a single financing solution so we can provide objective advice on the pros and cons of all solar financing options and advise you and your tax advisors on how best to maximize your cash flow and return on investment.

Learn more